in the last 1 to 3 Hours

Crime

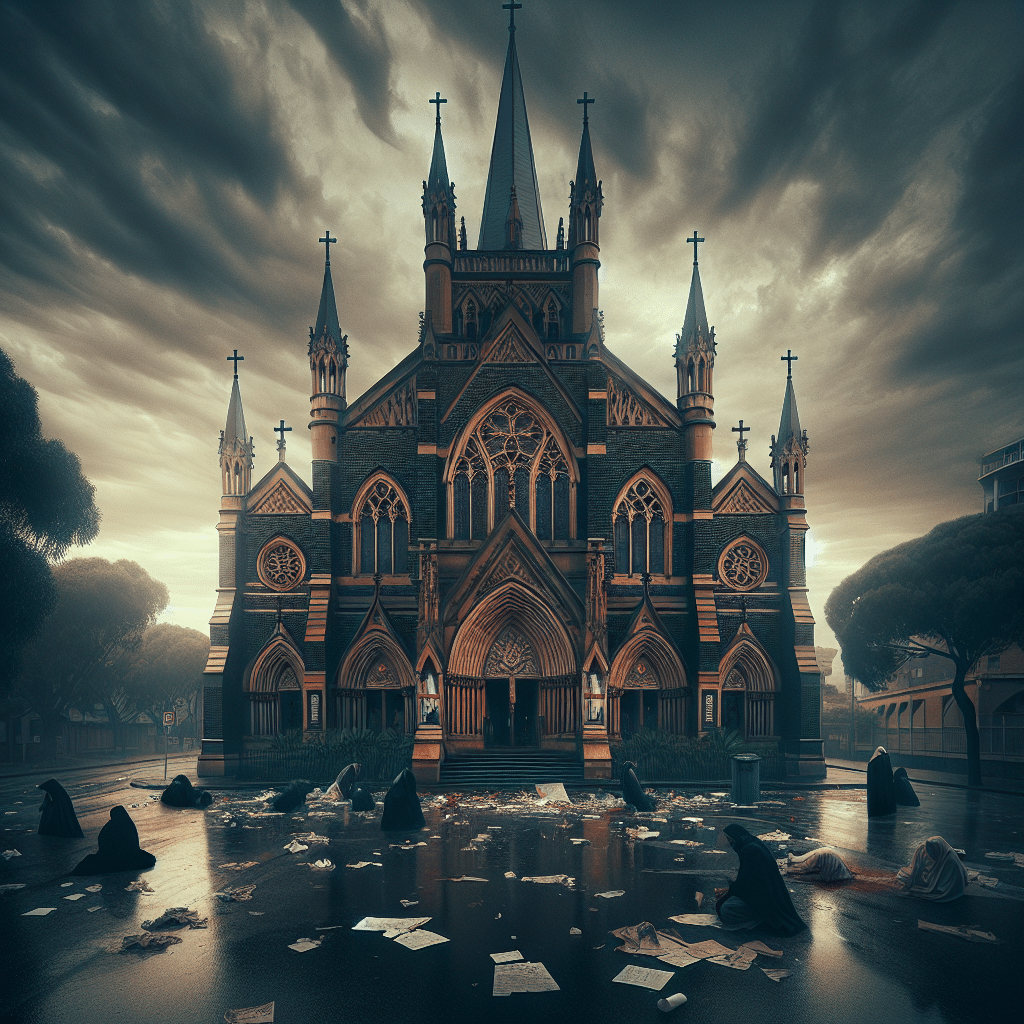

Terrorist Incident Unfolds at Assyrian Orthodox Church in Wakeley

UPDATES: 5 HOURS

Crime

Chancellor Myles Set to Rule on Release of Covenant Shooter’s Writings

Nashville, Tennessee – Chancellor l’Ashea Myles faces the critical decision of whether to allow the public release of writings by …

INSIDE SCOOP: 6 HOURS

Crime

Sexual Assault Perpetrator Found Guilty of Nine Offences After Violent Attack on Teenager

Whitby, North Yorkshire – A horrifying incident unfolded in Whitby, North Yorkshire when Dwayne Anthony …

in other news

STAY INFORMED: 9-12 hour news

Carjacking and Assault of Pizza Delivery Driver Caught on Camera in Houston Suburb

HOUSTON, Texas – A terrifying incident unfolded in a peaceful neighborhood near River Oaks as …

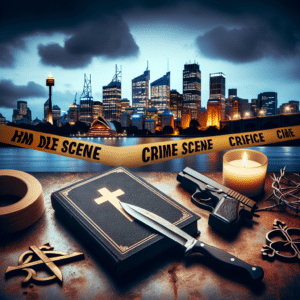

Terror: Teen Allegedly Stabs Sydney Bishop Over Religious Dispute

Sydney, Australia – A teenage assailant allegedly stabbed a bishop at a western Sydney church …

Manager Brutally Attacked and Knocked Unconscious at Restaurant

Perth, Australia – A restaurant manager in Perth, Australia, was brutally attacked and punched unconscious …

Sexual Assault Suspect in Venice Canals Faces Multiple Felony Charges

LOS ANGELES, CALIFORNIA – A man has been charged with multiple felonies after allegedly attacking …

Christian Community in Wakeley, Sydney Shattered After Church Stabbing Sparks Anger and Fear

Sydney, Australia – The stabbing incident at a church in Wakeley, located in Sydney’s western …

Elderly Man Murdered by Son in Tragic Attack

Preston, Lancashire – A tragic case unfolded in Preston when Austin Duckworth was found guilty …

Religiously Motivated Stabbing at Sydney Church Declared Terrorist Act by Australian Police

Sydney, Australia – Australian authorities have labeled the recent stabbing at an Assyrian church in …

Violent Attack on Sydney Bishop Sparks Call for Calm from Australian Archbishop and Religious Leaders

SYDNEY, Australia – In the aftermath of a violent attack on Sydney bishop, Archbishop Anthony …

Stabbing Shock: Fourth Violent Attack at Winnipeg Eatery Caught on Video

Winnipeg, Canada – A violent stabbing incident at a Smitty’s restaurant in Winnipeg was captured …

THe 13th hour

Attacker Robert Steven Ryder Receives Sentence for Townsville Worksite Incident

Townsville, Australia – A man named Robert Steven Ryder has been sentenced for his involvement …

Church Attack in Sydney Sparks Fear and Trauma for Assyrian Community Members

Sydney, Australia – The Assyrian community in Sydney was left in shock after a violent …