High-income individuals are prohibited from making direct contributions to a Roth IRA. If your income prevents you from making Roth contributions, a backdoor Roth IRA conversion might be a terrific method to take advantage of.

What is a backdoor Roth IRA?

A backdoor Roth IRA is not a unique account type. Instead, it is a mechanism that allows you to transfer funds into a Roth IRA even though your yearly income would otherwise preclude you from contributing directly.

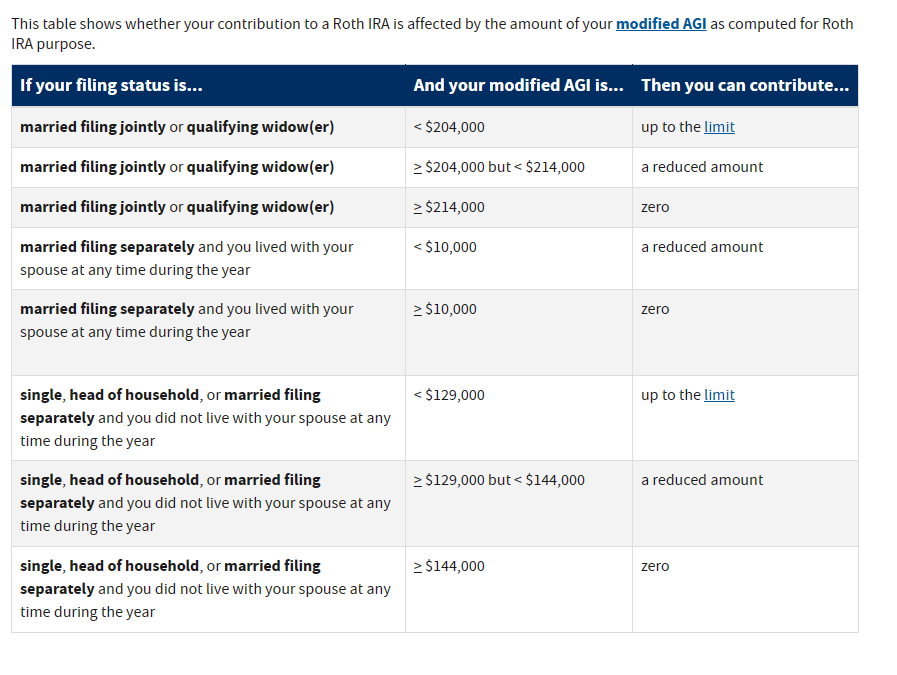

The following table details the yearly income limits for Roth IRA contributions. The backdoor Roth IRA technique allows you to sidestep these restrictions at the expense of increased tax payments.

Income Limitations for Roth IRAs 2023

How does a backdoor Roth IRA work?

Here is how it operates. Establish a new conventional IRA, make contributions that are not tax-deductible, and then convert the account to a Roth IRA. No income requirements exist for making non-deductible IRA contributions, but you must adhere to the yearly contribution restrictions.

Traditional IRAs may be converted to Roth IRAs regardless of annual income. But, a backdoor Roth IRA is most advantageous for high-income individuals having access to an employer retirement plan that disqualifies them from deducting regular IRA contributions.

You may also create a backdoor Roth IRA by transferring deductible conventional IRA or 401(k) contributions to a Roth IRA. Note you will likely owe taxes on the converted funds.

Backdoor Roth IRA Conversions: A Guide

When converting a traditional IRA to a Roth IRA via the backdoor, you must follow specific steps to avoid additional taxes and penalties. Follow these three steps carefully:

#1 Establish and fund a Traditional IRA.

Start by establishing a standard IRA. If you currently have a conventional IRA, there’s no reason you can’t convert it to a Roth IRA via the backdoor, but remember that the amount of taxes you owe may be affected. This is due to the IRA aggregation and pro-rata criteria, which we will cover later.

The key to funding a new conventional IRA is making non-deductible contributions (i.e., money on which you have already paid taxes and will not seek a deduction). In addition, you must file Form 8606 with the IRS, which lists your non-deductible donations.

#2: Learn How a Roth IRA Conversion Operates

Verify with your IRA providers regarding the necessary papers

for conversion to a Roth IRA. The process may be straightforward if your conventional IRA and Roth IRA are held with the same account provider.

A trustee-to-trustee transfer, in which one business transmits funds to another, should not be difficult if you have distinct providers for each IRA.

You may still establish a backdoor Roth IRA if your IRA provider does not oversee the funds transfer and issues you a check. But, the cheque must be deposited into a new Roth IRA account within sixty days. Otherwise, it may be regarded as a withdrawal in advance, which may incur taxes and penalties.

#3 Converting your Traditional IRA to a Roth IRA

Convert your new conventional IRA to a Roth IRA immediately. Do this as soon as feasible to eliminate your non-deductible contributions to your new traditional IRA from accruing investment gains, resulting in a tax liability when you convert to a Roth IRA.

There is no time restriction for converting a regular IRA to a Roth IRA. If you had current assets in an old conventional IRA and wished to limit prospective taxable gains, consider waiting until later in the year.

How to Begin a Roth IRA Conversion

Most brokerages can assist you with a Roth IRA conversion, particularly if you created a regular IRA with them. Choose a brokerage that offers conventional and Roth IRA alternatives that match your needs if you are starting a traditional IRA for the first time.

In 2023, you can contribute up to $6,500 to your regular and Roth IRAs or $7,500 if you are 50 or older. Formerly, the maximum amount that could be contributed to an IRA was $6,000, or $6,500 for individuals 50 or older.

To reduce the tax risks associated with a backdoor Roth IRA, make your yearly contribution lump sum and then promptly convert to a Roth IRA.

Factors Unique to a Backdoor Roth IRA

When seeking to convert a traditional IRA to a Roth IRA through a backdoor, you must be aware of certain IRA idiosyncrasies and tax implications.

Five-Year Restrictions Apply to Backdoor Roth IRAs

The five-year rule indicates that in most situations, even if you are over 59.5, you cannot withdraw Roth IRA gains tax-free (and frequently without incurring penalties) until your initial Roth investment was made at least five years earlier. You may often withdraw contributions from your Roth IRA at any time without incurring penalties or taxes.

There is a second five-year rule for backdoor Roth conversions. Since a backdoor Roth IRA is classified as a conversion and not a contribution, you cannot withdraw cash from the converted Roth IRA penalty-free for the first five years following the conversion.

If you perform a backdoor Roth IRA conversion each year, you must wait five years before withdrawing the funds. Otherwise, you risk incurring further penalties on already-taxed funds. But, there are exceptions to this rule if you are 59.5 or older, disabled, or have passed away.

Traditional IRAs, Including Contributions Deducted Earlier

The IRS treats all your conventional IRAs as a single account for calculating the taxes owed on withdrawals. Sadly, Roth IRA conversions are considered “distributions” by the IRS, and this fact substantially complicates backdoor Roth IRA conversions for those with current conventional IRA balances.

Because of this, you may owe taxes on the funds you seek to convert to a Roth IRA via the back door, even if the funds have already been taxed. This occurs when the IRS’s aggregate rule and pro-rata rule overlap.

According to the pro-rata rule, once money is deposited into an IRA, it is impossible to distinguish the component that has already been taxed from the piece deducted from taxes. The same principle applies to both pre-tax and post-tax IRA contributions.

Suppose 80% of the funds in your combined IRAs qualified for tax deductions and 20% did not. When performing a backdoor Roth IRA conversion, separating the previously taxed monies for conversion is impossible.

If you’re considering a backdoor Roth conversion, you should contact a financial professional who can assist you in managing the process and reducing any taxes you may owe. Rolling over a portion of your funds into a 401(k) not factored into pro-rata calculations may make sense.

Several states tax Roth IRA conversions through the back door.

Most states impose income taxes on these Roth conversions similarly to federal law. Nevertheless, several jurisdictions exclude a portion of a pension or IRA payment from taxation for those above a particular age.

Certain states may exclude the whole conversion amount from taxation, whereas states without a state income tax system do not tax conversion sums. If your backdoor Roth is subject to state or federal taxes, a tax expert can help you navigate them.

What About a 401(k) to Roth IRA Rollover?

Alternatively, you can convert a standard 401(k) to a Roth IRA. You would likely incur income tax on the converted funds unless you make non-deductible contributions to your standard 401(k).

Should You Consider a Roth IRA with a Backdoor?

Whether a backdoor Roth IRA is the best option depends on your circumstances. Before moving forward, carefully consider the repercussions.

Who Might Benefit from a Roth IRA Backdoor?

- High-income individuals who do not now qualified to contribute to a Roth IRA.

- Those who can afford the increased taxes associated with a Roth conversion desire future tax-free growth.

- Retirees who wish to avoid required minimum distributions (RMDs) (RMDs).

- Who Might Not Gain from a Backdoor Roth Account?

- Individuals whose annual income makes them eligible for regular Roth IRA contributions.

The five-year rule applies to Roth conversions, and thus anyone under 59.5 who withdraws converted money during the first five years may incur a penalty.

Individuals have additional traditional IRAs that complicate issues under the aggregate and pro-rata rules to the point where the tax repercussions exceed the advantages.

You should consult a financial advisor if you have substantial traditional IRA funds or if you have questions about backdoor Roth IRAs.

For more retirement news: